CEO Message

This year, we successfully transformed our balance sheet, highlighted by notable deposit and loan growth across our California and Midwest footprint. This accomplishment underscores our commitment to putting our clients first. These efforts have made First Bank a stronger institution, ensuring that we are well-positioned and capitalized to meet the needs of our clients today, tomorrow, and for generations to come.

We’ve recently celebrated significant milestones, including our exciting move into a new, state-of-the-art building in Creve Coeur, MO. In addition, we expanded into Texas with a new loan production office and added an additional branch in Cerritos, CA, furthering our commitment to sustainable, long-term growth.

We’ve recently celebrated significant milestones, including our exciting move into a new, state-of-the-art building in Creve Coeur, MO. In addition, we expanded into Texas with a new loan production office and added an additional branch in Cerritos, CA, furthering our commitment to sustainable, long-term growth.While intently listening to our clients and colleagues, we are refining our branch transformation strategy, making our locations more inviting and better aligned with our clients’ needs and expectations. Drawing from these valuable insights, we are taking a fresh look at our branches and will restart this transformation program in 2025.

With a client-centric mindset, we are striving to make it easier for clients to bank with us. In 2025, watch for new, enhanced checking products, improved online banking services for business and consumer clients, simplification in self-service and account opening options, and ongoing client-focused promotions.

Focused on Providing Our Clients What They Need to Succeed

As a multi-generational family-owned business, serving the holistic financial needs of our clients and communities remain constant. We intently position our clients at the forefront of our decision-making process. From technology and branch services to strategic partnerships and product offerings, First Bank continues to transform into the financial services partner our clients need us to be today, tomorrow, and for the future.

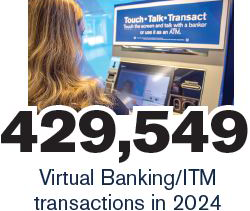

As a multi-generational family-owned business, serving the holistic financial needs of our clients and communities remain constant. We intently position our clients at the forefront of our decision-making process. From technology and branch services to strategic partnerships and product offerings, First Bank continues to transform into the financial services partner our clients need us to be today, tomorrow, and for the future.Since 2020, we’ve not only updated our branches but also our ATMs with Interactive Teller Machines (ITMs) throughout our locations while also expanding our friendly, knowledgeable Virtual Banking team. Our ITMs’ state-of-the-art technology allows clients to transact with expanded hours while speaking with a live, on-screen First Bank banker or utilize self-service options for things like balance inquiries, cash or check deposits, and withdrawals (up to their daily limit) or transfers.

From checking and savings to lending solutions, we strive to be a trusted resource for our clients throughout

their financial journey. Whether it’s time to purchase a first home, move-up to a larger home, or vacation home, or even to renovate an existing one, First Bank Mortgage has been delivering tailored lending solutions for over 30 years. To continue providing our clients with the mortgage services they need, First Bank Mortgage is implementing new technology for an improved client experience while also building up a team of knowledgeable Home Loan Advisors in areas where our clients need us.

their financial journey. Whether it’s time to purchase a first home, move-up to a larger home, or vacation home, or even to renovate an existing one, First Bank Mortgage has been delivering tailored lending solutions for over 30 years. To continue providing our clients with the mortgage services they need, First Bank Mortgage is implementing new technology for an improved client experience while also building up a team of knowledgeable Home Loan Advisors in areas where our clients need us.Although interest rates were at the highest level they’ve been in 18 years, First Bank Mortgage continued to keenly focus on providing exceptional client service this past year. This allowed our Home Loan Advisors to assist nearly 2,000 clients in purchasing their homes in 2024.

Focused on Helping Clients Build, Protect, and Transfer Wealth*

First Bank Wealth Management’s sophisticated approach to investment management allows clients to oversee separate accounts and specific stock portfolios, while accessing a transparent view of their investments. Clients can tailor their investments into a broad spectrum of areas that meet objectives for themselves, their family, and their philanthropic goals.

First Bank Wealth Management is excited to partner with a leading Certified Public Accountant (CPA) firm to provide prudent, updated tax guidance for clients. Not only has the team expanded by adding a dedicated financial advisor in Santa Barbara, CA, and increased the number of clients in the Midwest, but assets under management within the Brokerage business also grew at a record pace.

Focused on Protecting Clients, While Securing a Robust Infrastructure

At First Bank, we continue to stay a step ahead of bad actors by analyzing trends, partnering with other security leaders, and collaborating with law enforcement. Utilizing the National Institute of Standards and Technology (NIST) control and Zero Trust frameworks, First Bank has built a secure infrastructure powerhouse and continuously monitors and protects clients by using industry best practices.

Focused on Supporting Future Generations

In 2024, we proudly partnered with nearly 140 non-profit organizations across our footprint, including donating over $900,000 in cash contributions to reputable organizations such as: Habit for Humanity of Orange County, Family Forward – St. Louis, Hope the Mission, KIPP St. Louis Schools, and the Orangewood Foundation.

In the Midwest, we are proud to now partner with Girls Inc. – St. Louis in creating the newly-developed First Bank Business and Entrepreneurship Program. The initiative ran for six weeks during the summer of 2024 and will expand, adding a new cohort each year for the next five years, while equipping young women with valuable business and financial management skills.

In the Midwest, we are proud to now partner with Girls Inc. – St. Louis in creating the newly-developed First Bank Business and Entrepreneurship Program. The initiative ran for six weeks during the summer of 2024 and will expand, adding a new cohort each year for the next five years, while equipping young women with valuable business and financial management skills. In California, one of our most exciting partnerships is with Habit for Humanity of Orange County, “Keys to 100” initiative. Together, through a combination of financing, philanthropy, and volunteerism, we are helping to convert a beautiful nine-unit building in Santa Ana’s Floral Park District into the first-ever, affordable homeownership conversion condo project in the area.

Together, we are making a difference and empowering the next generation, families, and communities to envision and achieve their dreams. Looking ahead, we remain committed to a stewardship mindset—balancing growth with an unwavering focus on service. With optimism and gratitude, we are excited to continue this journey together this year and beyond. We thank our clients for trusting us. It’s a true honor.