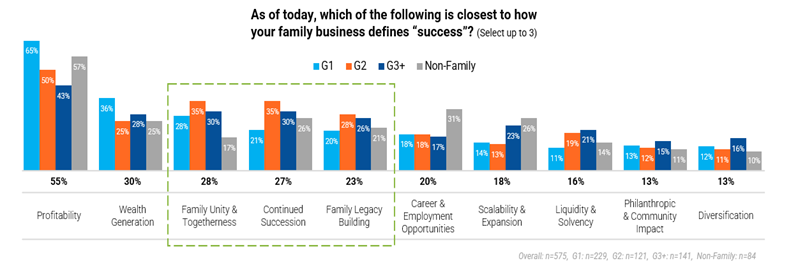

Wealth is the second most common answer when asked, “How does your family business define success?”

For family and privately-held businesses, wealth generation is woven throughout their prosperity, legacy, and future. Recent insights reveal that for many of these businesses, not only does the pursuit of financial wealth define achievement, but also their legacy building. Let’s explore the strategies and considerations that support the continued growth of wealth within family businesses, while also exploring its significance to the family.

Redefine Wealth

There are many elements to wealth that extend beyond monetary terms for family and privately-held businesses. “Elements such as family harmony, social impact, and personal fulfillment all play a significant role in how family members and their colleagues define success,” said Charles Claver, Director of the Private Wealth Advisor team for First Bank Wealth Management. “However, it’s also just as important to carefully align financial objectives with family values and aspirations for the future.”Strategize for Wealth Building

Claver explained varying strategies for wealth building. “The most successful business owners I work with gravitate toward real estate investments, ancillary businesses, and diversification of their investable assets into marketable securities. They often take a realistic approach,” he said. “Unfortunately, business owners aren’t always focused on building up an investment portfolio for passive wealth but rather their business at hand.”Continuing the growth of wealth within family businesses requires a multifaceted approach that balances immediate profitability with long-term sustainability.

Below are some diversification strategies to consider:

- Real Estate Investments: Investing in commercial properties (e.g., offices, retail spaces) and residential real estate can generate steady rental income and capital appreciation. For more liquid real estate exposure, consider investing in REITs, which allow for indirect investment in a diversified portfolio of properties.

- Equities and Bonds: Allocating wealth into a mix of stocks and bonds helps balance risk and reward. Equities offer growth potential, while bonds provide stability.

- Private Equity and Venture Capital: Investing in private companies or startups can lead to high returns. Family businesses often have the capital to take calculated risks in emerging industries.

- Commodities and Precious Metals: Diversifying into physical assets like gold, silver, or agricultural products can serve as a hedge against inflation and market volatility.

- Alternative Investments: Consider hedge funds, private credit, or even art collections. These assets often move independently of traditional markets and can provide additional diversification.

Maintain Open Dialogue and Invest in Education

It’s important to maintain open and transparent conversations within the family about wealth management, succession planning, and legacy preservation.- Education and Leadership. Invest in education and leadership development programs for younger family members. This ensures they are equipped with the skills and knowledge to manage and grow the business.

- Mentorship. Implement a mentorship program where seasoned family members guide the younger generation. Develop a clear succession plan to ensure a smooth transition of leadership.

- Financial Education. Offer financial education to all family members to ensure they understand the importance of wealth preservation and growth.

Balance Risk and Return

A prudent and disciplined approach to investment decision-making is critical for the long-term.- Strategic Asset Allocation: Establish a long-term asset allocation plan based on risk tolerance, investment horizon, and family goals. Regularly review and adjust the allocation to reflect changing circumstances.

- Tactical Asset Allocation: Short-term shifts in asset allocation can capitalize on market opportunities or mitigate risks. For example, increasing cash holdings during economic uncertainty.

- Geographical Diversification: Investing across different regions reduces exposure to economic or political risks in any one country.

Example Dilemma: Family Business Transition

The family business was run by Gen 1 (Boomer) for decades. They are deeply attached to the business because they built it from the ground up. Their primary goal is to maintain stability, preserve wealth, and ensure a smooth succession. They prefer a conservative approach to wealth management, focusing on risk-averse investments such as bonds, blue-chip stocks, and real estate. For them, legacy means preserving the family business as it is and ensuring its continued success for future generations.The second generation (Gen X), having grown up within the framework of the family business, understands its value but is also eager to innovate. They respect the business foundation but also advocate for diversified growth strategies. This generation is pushing for expanding into new markets, adopting digital technologies, and making investments in emerging sectors like tech or renewable energy. While they also want to preserve wealth, they are more open to calculated risks for future growth. Legacy, to them, involves modernizing the family business while maintaining its core values.

The Third generation (Millennials) are being more influenced by global trends and technology and have a completely different vision for the family legacy. They do not feel the same emotional connection to the family business and prefer to focus on sustainability, social impact, and purpose-driven wealth. For them, legacy involves using the family wealth to address social or environmental issues, through impact investing, charitable foundations, or have even discussed a desire to eventually sell the family business to focus on these causes. Their approach to wealth management is often more aggressive, with investments in startups, technology stocks, and alternative assets like cryptocurrencies.

Example Resolution: Family Business Transition

Gen 1 has resisted changes proposed by the younger generations because they prioritize stability and preserving the business in its current form. The second generation is trying to act as a bridge and modernize the business while respecting their parents’ conservative outlook.To bridge the divide, the family has established a family council where representatives from each generation come together to discuss and harmonize their goals. As a result, Gen 1 agreed to maintain the core of the business while allowing a portion of family wealth to be allocated to more innovative and impact-driven ventures.

As a result, Gen X maintained control of the business, while giving G3 the ability to lead philanthropic initiatives and manage impact investments that align with their values. This allowed them to feel connected to the family’s legacy while pursuing their own passions.

This approach fostered unity by respecting each generation’s views on wealth management and legacy, while ensuring that the family’s values and goals are honored across the board.

Seek Professional Guidance

It’s important to employ the guidance of professional advisors, financial planners, and wealth managers to provide guidance in navigating complex wealth management challenges. Claver added, “Building a long-term relationship with a trusted advisor that has an understanding of the unique dynamics of family and privately-held businesses, is important to generational success.”As family businesses focus on continued wealth generation, they’re also embracing a legacy of prosperity and purpose. By maintaining open communication, implementing prudent investment strategies, and aligning wealth generation with shared values and philanthropic endeavors, these families can better navigate the complexities of wealth preservation across generations. In doing so, they are not only securing their financial future but also their legacy.

To learn more about the First Bank Center for Family-Owned Businesses, our offerings for businesses, or to engage in a conversation about wealth building for your family or business, contact the First Bank Center for Family-Owned Businesses or visit www.first.bank/familybusiness.

|

Charles Claver is the Senior Vice President and Director of the Private Wealth Advisor team for First Bank Wealth Management. Possessing 25 years of experience in the financial services field, his expertise includes investment management, trust and retirement planning, individual/commercial insurance, and private banking/lending. You may reach him at (310) 887-0100 or via email at [email protected]. |