By Mike Dierberg, Chairman, First Bank

Originally published in the St. Louis Business Journal, May 2024

In 2021, First Bank launched its Center for Family-Owned Businesses to provide family businesses the insights, solutions and networking opportunities they need to be successful, as well as the solid framework necessary for building upon their family business legacy.

To stay apprised of the specific needs and challenges of family businesses, we again commissioned the expert assistance of market research firm MacKenzie Corporation, a second-generation family business in Orange County, California, to conduct our 2024 Family Business Survey.

Family-owned businesses drive our communities, and the survey highlights their enduring strength, resilience and innovative spirit on a day-to-day basis. We received valuable input and insights from 575 qualified respondents,* and the following are three key findings from the survey.

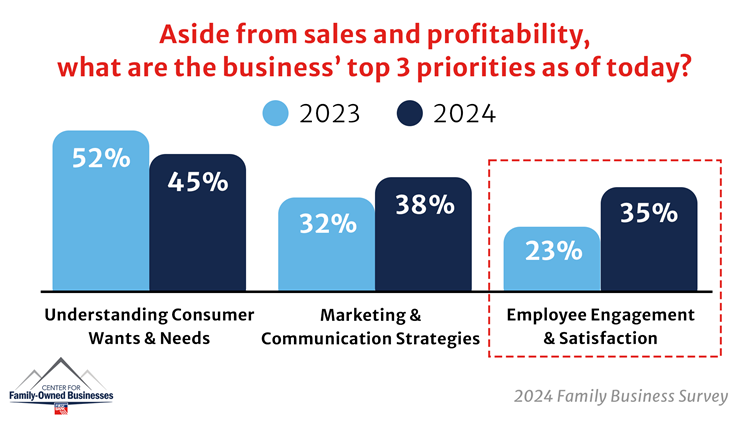

1. From 2023 to 2024, the focus on employees and employee satisfaction by family businesses increased by significant margins.

Survey result: The most notable changes from the survey are focused on employees. “Employee engagement and satisfaction” rose 12 points as a top priority (23% vs. 35%).

Key takeaway: In the dynamic landscape of family businesses, leaders are continually adapting to shifting priorities to maintain their competitive edge. It's evident that beyond the perennial focus on sales and growth, another beacon is illuminating the path to success: employee satisfaction and engagement.

2. Profitability is the top overall “success” metric for family-owned businesses. But after that, things change by generation.

Survey result: Overall, profitability is the top success metric (55%). However, there is a significant drop-off in “profitability” selection frequency from the first generation (65%), moving to the second generation (50%), and beyond (43%). While the importance of profitability as a success metric declines with later generations, the importance of family unity, togetherness and continued succession increases for successive generations.

Key takeaway: In the tapestry of family business success, the thread of wealth generation weaves a narrative of prosperity, legacy and opportunity. Our survey revealed that for many family businesses, the bonds of family through multi-generational wealth stands as a defining marker of achievement, signaling not only financial success but also the perpetuation of a legacy across generations. In addition, our survey suggests differences in perspective between the first and often most entrepreneurial generation versus the broader goals of later generations who were likely raised with more secure financial circumstances.

3. Overall optimism regarding the economy, anticipated business growth and the longevity of the family business rose.

Survey result: Optimism scores regarding the economy rose 12 points (49% vs. 61%), expected revenue growth rose nine points (66% vs. 75%) and belief that current models can withstand uncertainty rose seven points (61% vs. 68%).

Key takeaway: Overall confidence in the economy rose strongly in the last 12 months, with a level-of-agreement rating of 61 out of 100, where respondents indicated, “I feel confident in the direction of the economy over the next year,” resulting in a 12-point increase.

To find out how First Bank can help your family-owned or privately-held business thrive or to receive a full copy of the findings from the 2024 Family Business Survey, visit first.bank/familybusiness.

In conjunction with our First Bank teams, we’re committed to positioning family businesses for growth and success. In addition to the survey, webinars, a symposium, roundtable discussions and networking opportunities, the First Bank Center for Family-Owned Businesses also provides other services, including consulting, guidance, insights and online resources, at first.bank/familybusiness.