CEO Message

Our culture is not defined solely by our heritage; it is defined by action. It comes to life through the people who treat this bank as if it were their own business, who show up with purpose, and who deliver the kind of personal care that turns “family owned” from a structural description into a lived experience. I am grateful to the Dierberg family for their trust and partnership, and equally grateful to our colleagues who bring our values to life.

Strategic Growth with Purpose: Expanding Our Presence in Texas

Our long‑standing commercial markets in the Midwest and California continue to demonstrate the strength of our relationship‑driven approach. These teams deliver disciplined performance, deep client partnerships, and the steady execution that has defined First Bank for generations. Their success forms the foundation of our commercial strategy and reinforces our belief that when we invest in people, relationships, and long‑term thinking, strong results follow.

Our long‑standing commercial markets in the Midwest and California continue to demonstrate the strength of our relationship‑driven approach. These teams deliver disciplined performance, deep client partnerships, and the steady execution that has defined First Bank for generations. Their success forms the foundation of our commercial strategy and reinforces our belief that when we invest in people, relationships, and long‑term thinking, strong results follow.Building on that foundation, the progress we have made in Texas is a clear example of our stewardship mindset in action. When we committed to expanding our presence in the Dallas–Fort Worth region and investing in our Plano‑based Mortgage Warehouse Lending team, we did so with intention and a long‑term view. We believed Texas represented an opportunity to serve clients in some of the nation’s most dynamic markets, and the results from 2025 affirmed that belief.

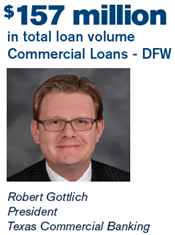

Our Fort Worth commercial loan production office came into 2025 with strong market momentum and our team built on that strength throughout the year. By focusing on commercial lending and dealer floor plan financing, we aligned our efforts with the heartbeat of the DFW business community. These are more than numbers; they reflect new relationships and deepened partnerships. The Dallas–Fort Worth region continues to be one of the fastest‑growing business environments in the country, and our ability to serve clients with a disciplined, relationship‑driven approach positions First Bank as a strong and stable partner amid rapid growth.

Our Mortgage Warehouse Lending team in Plano also had a standout year, demonstrating the value of a scalable, well‑structured operation in an industry that demands speed, expertise, and reliability. This business has become an important engine within First Bank. By delivering consistent execution and service, our warehouse lending team is strengthening our brand, not just in Texas, but nationwide.

Our Mortgage Warehouse Lending team in Plano also had a standout year, demonstrating the value of a scalable, well‑structured operation in an industry that demands speed, expertise, and reliability. This business has become an important engine within First Bank. By delivering consistent execution and service, our warehouse lending team is strengthening our brand, not just in Texas, but nationwide.Today, our Texas footprint includes colleagues across IT, Enterprise Project Management, Credit, and Commercial Lending, creating a foundation that positions us for sustained growth in the region. Texas is not simply another market for us. It is a strategic hub where we are committed to expanding our capabilities, deepening partnerships, and supporting businesses that are fueling economic growth across the state.

Guiding Family Businesses Through a Unique Landscape

Our lived experience as a family-owned institution is also why we place such importance on the First Bank Center for Family-Owned Businesses. Family enterprises operate in a unique environment where business logic and family dynamics intersect. The Center exists to help clients navigate governance, succession, and growth; challenges we understand firsthand.

Our lived experience as a family-owned institution is also why we place such importance on the First Bank Center for Family-Owned Businesses. Family enterprises operate in a unique environment where business logic and family dynamics intersect. The Center exists to help clients navigate governance, succession, and growth; challenges we understand firsthand.Because we have walked this path ourselves, we can offer more than capital. We offer perspective, guidance, and a roadmap for families who are building something meant to last. This work is an extension of our identity and a reflection of our belief that strong family businesses strengthen communities, economies, and future generations.

Strengthening Communities Through Service

When devastating wildfires swept across California early in the year, many families were displaced, including some of our own First Bank colleagues. Our teams mobilized quickly, partnering with Hope the Mission, the YMCA of Metropolitan Los Angeles, and California Love Drop to provide essential supplies and support. Each Southern California branch opened its doors as a collection center for non‑perishable food, hygiene products, blankets, and other urgently needed items. These efforts demonstrated a simple truth: when we come together, even small acts of kindness become powerful.

When devastating wildfires swept across California early in the year, many families were displaced, including some of our own First Bank colleagues. Our teams mobilized quickly, partnering with Hope the Mission, the YMCA of Metropolitan Los Angeles, and California Love Drop to provide essential supplies and support. Each Southern California branch opened its doors as a collection center for non‑perishable food, hygiene products, blankets, and other urgently needed items. These efforts demonstrated a simple truth: when we come together, even small acts of kindness become powerful.Tornado outbreaks across the Midwest in March and May also called our teams to action. During our Volunteer Community Day, employees rolled up their sleeves to assist with cleanup efforts, support relief organizations, and provide hands‑on help to neighbors in need.

Beyond crisis response, our employees dedicated thousands of hours to supporting young people through financial literacy programs, mentoring, academic support, and youth development initiatives. These efforts reflect who we are at our core. We are more than bankers; we are members of the communities we serve, and we stand ready to support them in moments of need and moments of opportunity.

Beyond crisis response, our employees dedicated thousands of hours to supporting young people through financial literacy programs, mentoring, academic support, and youth development initiatives. These efforts reflect who we are at our core. We are more than bankers; we are members of the communities we serve, and we stand ready to support them in moments of need and moments of opportunity.Our culture of service is strengthened by employee-led councils that champion diversity, well-being, sustainability, and community engagement. Their work reinforces that service is not an initiative; it is a shared value that defines who we are.

Looking Ahead with Optimism and Gratitude

Thank you to the Dierberg family for their unwavering trust, to our colleagues for bringing our culture to life, and to our clients for choosing us as your partners. I look forward to the year ahead with optimism and gratitude.

Mikel Williamson

President and CEO

First Bank | FB Corporation